Within your typical middle to large scale, multi-departmental, high turnover business, budgeting is commonplace. Within this type of organisation, a budget ensures that the individual or department spends well (within the defined constraints agreed by the board). It also ensures that they spend enough, in order to supplement the growth and improvement of the department or company as a whole.

In addition, a budget also saves lots of time during the financial year. It gives buyers autonomy with their spending by removing the formal purchasing process. This cumbersome process is saved for larger spends and binding contractual agreements, for example. In a nutshell - with effective budgeting in mid-large size businesses, middle management don't have to obtain approval from a signatory to make a purchase, as long as it falls within their annual spend. Smiles all round!

What about small businesses?

So, how does this procedure of budgeting apply to a smaller scale, owner-managed business that has a far lower turnover and may consist of a hybrid team whose roles are overlapped or even shared?

Budgeting for smaller businesses brings an entirely different and unique proposition to that of the larger business, outlined above. Let's delve into this topic and discover what budgeting means for small businesses, how to go about doing it yourself, and provide some justification as to why you should budget as the manager of a small business.

Benefits of budgeting for small businesses

For a small business, the reasons to get involved in budgeting heavily outweigh the reasons not to do so. In fact, the only perceivable downside is the initial time investment, which you'll undoubtedly gain back further down the line in the form of enhanced sales and advertising, crystal clear cost analysis and more informed decision making. Plus, a host of other efficiencies that aren't time-related. No brainer!

- Stay on top of cash flow: your budget will tell you exactly what your monthly incomings and outgoings look like at any one point in time, giving you piece of mind of financial security and a healthy, growing cash balance in the bank.

- Improve income and margins: with an accurate picture of where your money is coming from, you can easily identify areas for improvement through upselling into your lucrative customer accounts and strategically developing those that aren't perhaps performing as well as they could do. Same number of customers, more income!

- Expense management: a well formulated budget will identify variable and fixed costs worth analysing further. A business must invest to serve its customers and to grow, so we don't want to encourage slashing outgoings at all costs! However, as a small business owner, it's vital to regularly ask yourself the question “is this expenditure justified?”.

- Monitor performance: understanding where your business performs well is invaluable. You can maintain efforts in these areas and expect linear returns. However, perhaps even more importantly, a budget will also identify areas which are underperforming. As an example, take a service/MOT centre that performs fantastically on their service bookings, but receives significantly fewer MOTs. Like a customer audit (outlined in bullet point 2), conduct one on your internal processes via your budget.

- Seasonal variability: many sectors are heavily season-dependant in terms of footfall, inbound enquiries, bookings and consequently, income. Through maintaining a budget, you can extract rich data from previous months and years, allowing you to plan accordingly for future peaks and troughs. This will positively impact and refine your hiring strategy, purchasing, marketing approaches, dividends, annual leave structure – everything! Don't get caught flying blind.

- Maximise decision making: a budget effectively provides the small business owner with an ongoing live feed of key information about the inner workings of their organisation. Anything you may wish to know that could feasibly dictate the direction you choose to take, will be supplied in great detail within the budget. After all, the day-to-day decisions made in small businesses can, proportionately, have much greater effect than they do in a large multi-national. Accuracy is imperative.

- Preparing for unforeseen costs: all businesses, small and large, require a cash reserve on which to fall back on in the event of an emergency or an unforeseen, severe economic change. By providing an accurate analysis of running costs and revenue, your budget will allow decision makers to decipher what proportion of their profits they can transfer into an emergency fund on a monthly, quarterly, and yearly basis. Without an up-to-date budget to refer to, it's impossible to quantify the amounts transferred into each savings pot.

Whilst this isn't an exhaustive list, it goes some way to illustrating the benefits to be had in investing the time and effort into writing a budget. Whilst many small businesses do operate (to varying degrees of success) without one, citing lack of knowledge or time constraints as justification for this, it is of little doubt that a budget would vastly improve their business and their capabilities as decision makers. When you consider that perhaps the most common challenge facing small businesses is their cash flow management and overhead control, it's remarkable to think that budgets aren't at the very top of everyone's priority list.

With that said, let's answer the question on everybody's lips – how do I go about writing a budget for my business?

Business budgeting template

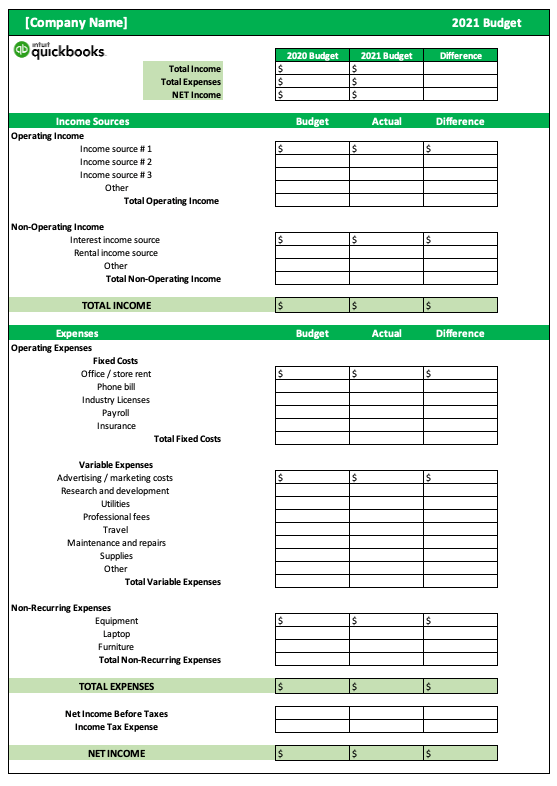

Assuming you haven't prepared a budget before, knowing which costs, revenue sources, incomings, and outgoings to include in your document can seem like a formidable task. To help with that, we have included a pre-made small business budget spreadsheet for you – put together by the team at Quickbooks.

Image source: https://quickbooks.intuit.com/

As you can see, this is a standardised budget framework. To tailor the document to your own business, you will of course need to populate the figures correctly, allowing for an accurate reflection of your financial position. If you'd prefer to structure your budget yourself to focus more on a particular goal, time-period or business need, you can easily edit and alter the fields as required.

You get out what you put in

Congratulations! You've made the decision to go for it – it's time to incorporate budgeting into your day-to-day. By now, you've written your budget, populated the correct figures to accurately reflect your business and edited your fields to tailor the document to your business goals, your chosen timescale and your unique business needs.

Whilst the bulk of the hard work is done, from this point onwards, it's totally down to you. Ultimately, your budget is only as good as the data you provide, the accuracy of that data, and the quality of its ongoing maintenance. So, to ensure you receive the maximum benefit and value from your budget, you need to stay on top of it by committing to regular updates and cross referencing your data entries.

At this stage, consider enhancing your budgeting process even further by automating the process of financial reporting, revenue analysis and expense tracking. You can do this by investing in an accountancy software like Xero for its data extrapolation potential, combining that with your own budget document. This kind of software collates your entries and presents the important information for you in a succinct, informative format, meaning you can then populate your budget fields with live information that is guaranteed to be deadly accurate.

In summary, the very best money managers out there are the ones that treat their budgets like a living, breathing snapshot of the business' financial position. They understand that it's impossible to profit from the many invaluable benefits of budgeting (outlined above in the ‘Benefits of budgeting for small businesses' section of this article) without putting in the heavier work to begin with, and systematically topping up their data accuracy thereafter. By budgeting this way, you'll reap what you sow for years to come.